Understanding the Basic Components of a Budget

Almost 30% of Americans don’t budget because they simply don’t think they need this tool. Budgeting is an essential aspect of personal finance, yet many find it intimidating and complex. If you are new to managing your finances, there is no need to worry. This comprehensive guide will walk you through the basic components of a budget, making it approachable and easy to implement

Whether you’re a student, a stay-at-home mom, or just starting your career, understanding budgeting can transform your financial health. As stated by Damion McIntosh, a finance expert at Auburn University, personal budgeting is critical for tracking and managing expenses and serves as an accountability tool. This guide will break down the basic components of a budget, helping you take control of your finances, one step at a time.

What Is a Budget and Why It’s Crucial

A budget is a financial plan that allocates future personal income towards expenses, savings, and debt repayment. Serving as a roadmap for your financial activities, it enables informed decisions about spending and saving. For instance, a survey by Debt.com revealed that 88% of respondents believe budgeting has helped them avoid debt.

Although budgeting is often perceived as restrictive, it is empowering. By setting clear financial goals and tracking your expenses, you can achieve both financial stability and peace of mind. By taking the time to establish a budget, you lay the foundation for a more secure and predictable financial future. Now, let’s delve into the specific components that constitute a well-rounded budget and how to effectively manage each element. But first, let’s also address some common misconceptions:

- Budgeting Limits Your Freedom: Many believe that a budget restricts them from enjoying life. On the contrary, budgeting allows you to allocate money for leisure activities without guilt.

- Budgeting Is Only for People with Financial Problems: Budgeting benefits everyone, regardless of income level. It helps you manage your money more effectively and prepare for unexpected expenses.

- Budgeting Is Too Complicated: Modern tools and apps simplify budgeting, making it accessible for everyone, even those with minimal financial knowledge.

- Budgeting Means You Can’t Be Spontaneous: Some think budgets prevent spontaneous spending, but budgeting can make room for unplanned purchases by setting aside a “fun money” category.

- Budgeting Takes Too Much Time: While it might seem time-consuming at first, once set up, budgeting can be maintained with minimal effort.

Understanding and dispelling these common misconceptions is essential for adopting a positive outlook toward budgeting. By perceiving budgeting as an empowering tool rather than a restrictive measure, you can harness its full potential to secure your financial future. Budgeting is not about eliminating every indulgence but about making informed decisions that align with your financial objectives. With the correct perspective and resources, budgeting can simplify your life and reduce financial stress.

Core Components of a Budget

Now that we’ve addressed some of the common misconceptions, let’s delve into the core components of a budget. Understanding the core components of a budget is the first step in mastering your finances. Here’s what you need to know:

Income

Income is the money you receive from various sources like salary and freelance work. Knowing your total income helps you set realistic financial goals and allocate funds accordingly.

- Regular Income: This includes your monthly salary or any fixed earnings.

- Irregular Income: This includes bonuses, freelance payments, or side hustle earnings.

Expenses

Expenses refer to the costs incurred in your daily life. They can be divided into two categories: fixed and variable expenses.

- Fixed Expenses: These are regular, unchanging costs such as rent, utilities, and insurance. Fixed expenses remain constant over time, providing predictability in your budget.

- Variable Expenses: These are costs that fluctuate monthly, including groceries, entertainment, and dining out. Variable expenses can vary significantly, requiring careful management to maintain financial balance.

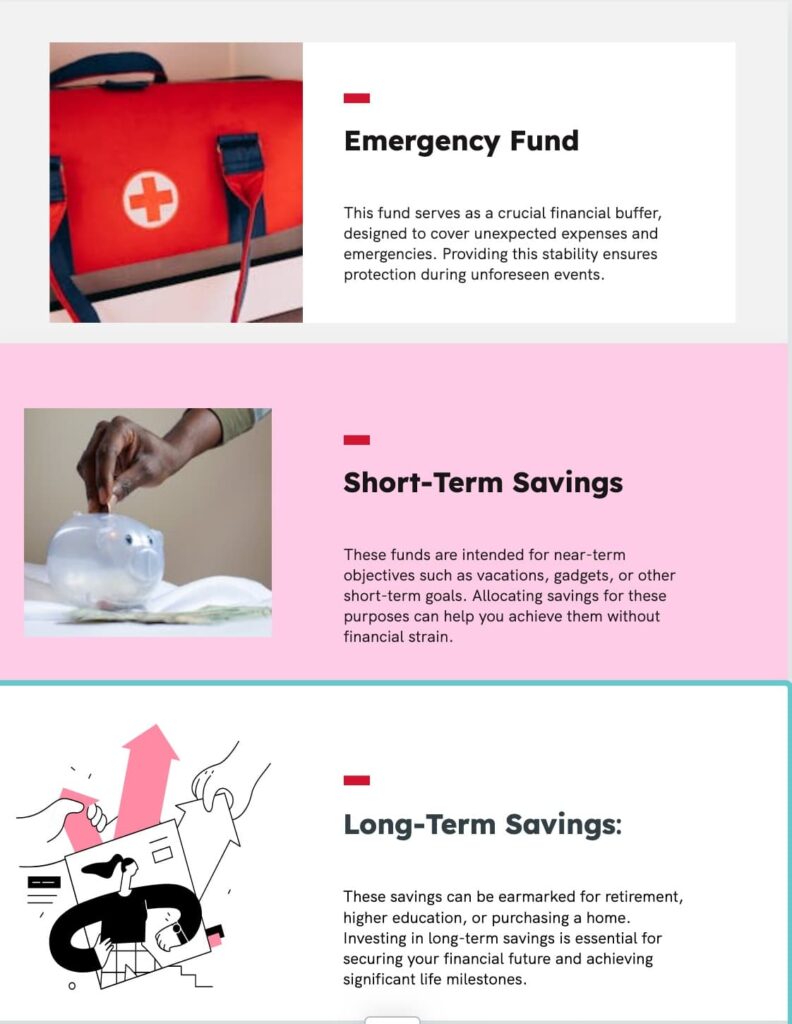

Savings

Savings are funds that are set aside for future use. It is essential to prioritize saving to build an emergency fund, plan for significant purchases, or invest in long-term goals. Here is a detailed guide to different types of savings:

By understanding and implementing these types of savings, you can better manage your finances and ensure stability and growth over time. Once you’ve established a solid savings plan, the next crucial step is to incorporate effective debt repayment strategies into your budget.

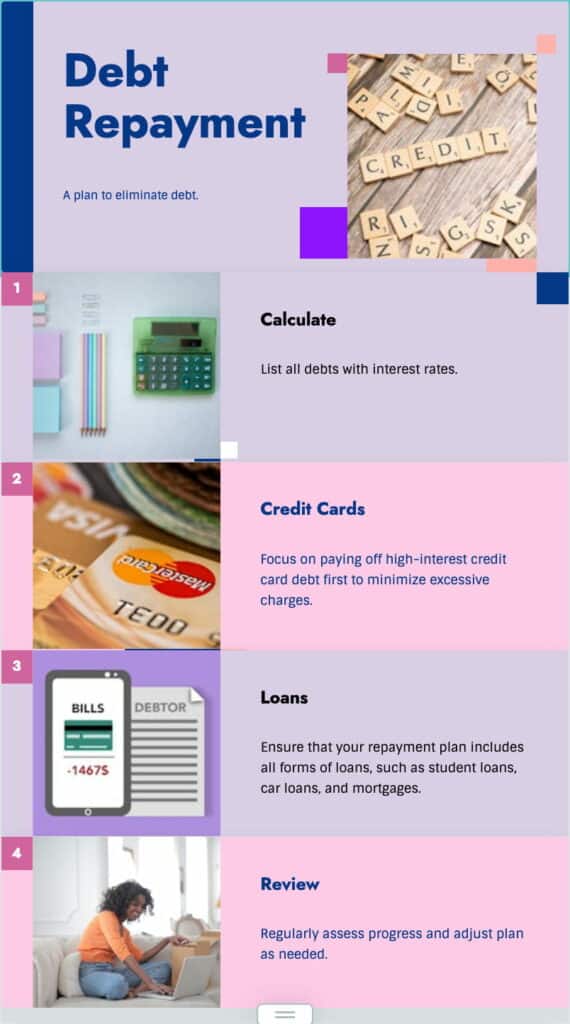

Debt Repayment

Managing debt is crucial for maintaining financial health. It’s important to allocate a portion of your budget specifically for debt repayment to systematically reduce high interest and financial strain.

- Credit Card Debt: Focus on paying off high-interest credit card debt first to minimize excessive charges.

- Loans: Ensure that your repayment plan includes all forms of loans, such as student loans, car loans, and mortgages.

By following a structured repayment plan, you can efficiently manage and decrease your debt, paving the way for better financial stability. With the fundamental concepts now clear, the next step is to implement a budget to enhance financial control even further.

Implementing Your Budget

Now that you understand the components, let’s discuss how to create and implement your budget effectively.

Set Clear Financial Goals

Identify your short-term and long-term financial goals to maintain focus and motivation. These goals might include:

- Saving for a vacation

- Reducing debt

- Building an emergency fund

By clearly defining these objectives, you can create a structured plan to achieve them, ensuring a disciplined and strategic approach to your financial well-being.

Utilize Budgeting Tools and Apps

According to third-party reviews, budgeting tools consistently receive high user satisfaction ratings due to their comprehensive features. Incorporating these tools into your financial routine can significantly aid in:

- Tracking expenses

- Setting and achieving specific financial goals

- Precisely analyzing spending patterns

These resources offer a detailed and user-friendly approach to effective financial management. By leveraging these tools, you can gain a clearer understanding of your financial habits and make informed decisions to enhance your financial well-being.

Track And Adjust Your Budget

Maintaining alignment between your budget and financial goals requires regular reviews. Life changes and unexpected expenses may necessitate budget adjustments.

- Monthly Reviews: Conduct a thorough examination of your monthly expenditures, making the necessary adjustments to budget categories to ensure financial stability.

- Quarterly Reviews: Evaluate your progress towards long-term financial goals quarterly, implementing any required modifications to stay on track.

Consistently monitoring and refining your budget is crucial to ensure that your financial strategy remains effective and aligned with your evolving goals. This practice enables you to adapt to changing circumstances and make informed decisions. By regularly reviewing your budget, you can identify areas for improvement, improve how resources or income are used, and stay on track toward achieving your financial objectives. Next, we’ll explore strategies for overcoming common budgeting challenges.

Overcoming Budgeting Challenges

According to a survey by NerdWallet, 84% of Americans with a monthly budget have sometimes exceeded it, and 83% of Americans admit to overspending. Sticking to a budget can be challenging.

To effectively manage your finances and maintain control over your budget, consider the following strategies:

Impulse Buying

Impulse buying can significantly derail your budget. To effectively address this issue, carefully make a complete shopping list and stick to it. Allocate a small portion of your budget for occasional treats to avoid feelings of deprivation.

- Create a Realistic Shopping List: Identify your essentials and extras in advance to stay focused during shopping trips.

- Stick to Your List Like a Pro: Keep your list on hand and cross off items as you go to resist unplanned buys.

- Budget for Rewards: Set aside a small, guilt-free allowance for treats to enjoy without overspending.

- Plan for Flexibility: Allow some wiggle room in your budget for unexpected but necessary purchases.

By following these practical steps, you can better control your finances and reduce the impact of impulse buying, making budgeting a more manageable and rewarding task.

Unexpected Expenses

Life’s unpredictability often brings unexpected expenses that can arise at any moment. Being prepared for these unforeseen costs is crucial to maintaining financial stability.

Key Points:

- Unforeseen Costs: Life can bring unexpected financial challenges.

- Emergency Fund: Acts as a financial buffer against these surprises.

- Consistent Contributions: Regularly adding to your fund ensures readiness.

- Financial Stability: A well-maintained emergency fund supports overall financial health.

By following these guidelines, you can handle surprise expenses with ease and keep your finances steady.

Lack of Motivation

Maintaining motivation can indeed be challenging. To ensure you stay on track, it is helpful to consistently remind yourself of your financial objectives and acknowledge small wins along the way. Here are some effective strategies:

- Every month, take a bit of time to review and tweak your financial goals. It’s like giving your budget a health check.

- Celebrate small wins! Hit a savings milestone? Treat yourself to something small to keep the momentum going.

- Share and learn from real-life budgeting experiences to tackle financial challenges with confidence. These experiences can offer new budgeting tricks and boost your confidence.

These straightforward, practical strategies can help you reach your financial goals without getting stressed. Give them a shot and experience the difference!

Long-Term Financial Planning

A budget serves not only to manage day-to-day expenses but also as a crucial instrument for long-term financial planning.

Practical Investment Strategies

First, take a look at your budget to see how much you can realistically put aside for investing. Use trusted financial resources and online tools to check out practical options like low-cost index funds, high-yield savings accounts, and employer-sponsored retirement plans. These strategies are designed to fit different income levels, making them accessible and actionable for everyone.

Achieving Financial Freedom

Practical budgeting and disciplined saving are crucial steps toward financial freedom. Begin by setting realistic savings goals and tracking your expenses. Even small, consistent contributions to your savings can add up over time, helping you maintain a comfortable lifestyle without depending solely on your paycheck. This approach is accessible and relevant to different income levels, making it achievable for everyone.

Adjusting To Life Changes

Big life changes like getting married, having a baby, or switching careers can impact your finances. It’s key to tweak your budget to keep things steady. Here’s how you can handle it:

- Check Out Your New Financial Situation: Look at your income, expenses, and any new financial responsibilities that come with the change.

- Revamp Your Budget: Adjust your budget to fit these changes and make sure you’ve covered all new expenses.

- Think Ahead: Start small by setting aside a bit each month for future needs. Even a little bit can grow over time and make a big difference when you need it.

By adhering to these steps, you can maintain financial stability and be well-prepared for any future financial challenges.

Key Takeaways

It is important to recognize that budgeting is not merely an exercise but a crucial mindset. It lays the foundation for financial freedom and empowerment. The ability to control your finances is determined not by the size of your income but by your capacity to understand, manage, and allocate it effectively.

Whether you are a student, a parent, a freelancer, or a professional, a well-structured budget can transform your financial management. By utilizing modern budgeting tools and making regular adjustments, budgeting can become a seamless part of your routine.

Here are key points to consider:

- Start today: Take the first step towards monetary discipline.

- Every small step counts: Each effort contributes to a more secure financial future.

- Continuous learning: Join my mailing list to stay updated on budgeting insights.

- Share your success: If you have a budgeting success story, share it at hello@themisfitfinance.com.

Empower yourself financially, as you deserve a life free from financial stress. Financial literacy is the key to unlocking a world of opportunities so join my mailing list so you are the first to know when new blog posts are published. Happy learning!