Traditional vs. Digital Banking: A Comprehensive Guide

Understanding the shift: the rise in digital banking

Did you know that 8 out of 10 Americans believe that new tech in banking is making it easier for everyone to handle their money? But when it comes to traditional vs digital banking, what really is the difference? In this article, we’ll cover many of these differences.

The evolution of banking: traditional to digital

Candidly, today’s digital age has changed the way we manage our finances. Traditional brick-and-mortar banks are no longer our only options to manage money. The evolution of technology continues to be a game-changer for the finance industry, offering convenience and easy access like never before. With 80% of Americans believing in the positive impact of banking technology, it’s crucial to understand the fundamental differences when it comes to your traditional vs digital banking options so you can make informed financial decisions.

Navigating the differences:

In today’s ever-changing financial environment, traditional banks and digital banks both offer their own advantages and drawbacks when it comes to accessibility, security and convenience. This article aims to examine the differences between the two when it comes to traditional vs digital banking. By the end, you’ll have a clearer understanding of which banking option vibes best with your financial needs and preferences. Ready? Let’s get into it.

Accessibility: Accessing Your Finances

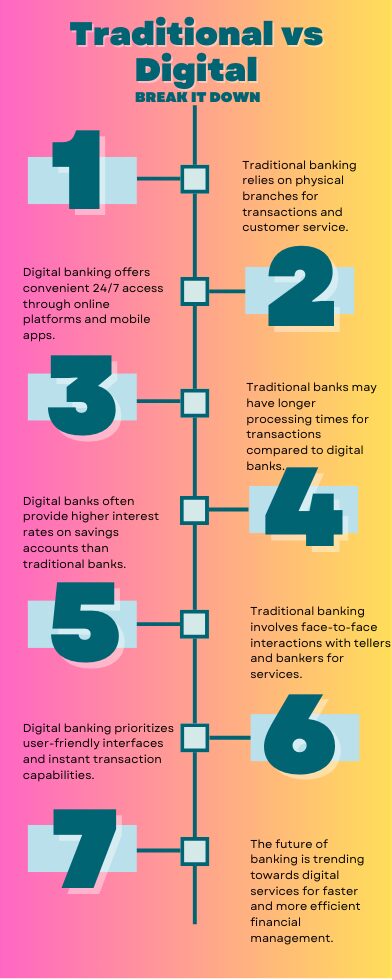

Branch Network vs. Online Presence

Traditional banks operate through a web of physical branches, making it possible to speak with a teller or banker face to face. Traditional vs digital banking in terms of accessibility is one of the main factors that differentiate these two options. Because you can visit a branch for personalized service, whether it’s opening an account or discussing a loan. On the other hand, digital banks operate entirely online, providing 24/7 access to banking services through mobile apps and websites. There’s no need to visit a branch, but keep in mind you won’t have in-person assistance either.

Account Management

Building on the differences in accessibility between traditional vs digital banking, managing your account also varies significantly between the two types of banks. Traditional banks often require you to visit a branch for tasks like depositing checks or getting certain types of customer service. Digital banks, however, allow you to handle these tasks online. For example, you can deposit checks by taking a photo with your smartphone. It is important to note however, that traditional banks have made services that you previously had to go into the branch for, such as mobile deposit, available online as well. Also, digital banks tend not to accept cash.

Geographical Limitations

Traditional banks are also geographically bound. You may face difficulties accessing your bank in person if you move or travel frequently. Digital banks, being online, remove these geographical limitations, providing global access to your accounts wherever you have an internet connection.

Wrapping It Up

While traditional banks offer the comfort of face-to-face interaction because of the physical locations they offer, when it comes to traditional vs digital banking, digital banks provide unmatched convenience with 24/7 online access and no geographical limitations due to not having physical branches. Choose based on whether you value in-person service or the ability to manage your finances anytime, anywhere.

Safe and Simple: Navigating Security in Traditional vs. Digital Banking

Fraud Protection

When it comes to traditional vs digital banking, security is a major concern for both. Traditional banks have long-established fraud protection measures and are typically insured by the FDIC, adding an extra layer of security. Digital banks also offer robust security features, such as encryption and two-factor authentication, but they haven’t been around as long, which might make some customers who are sensitive about security and privacy wary.

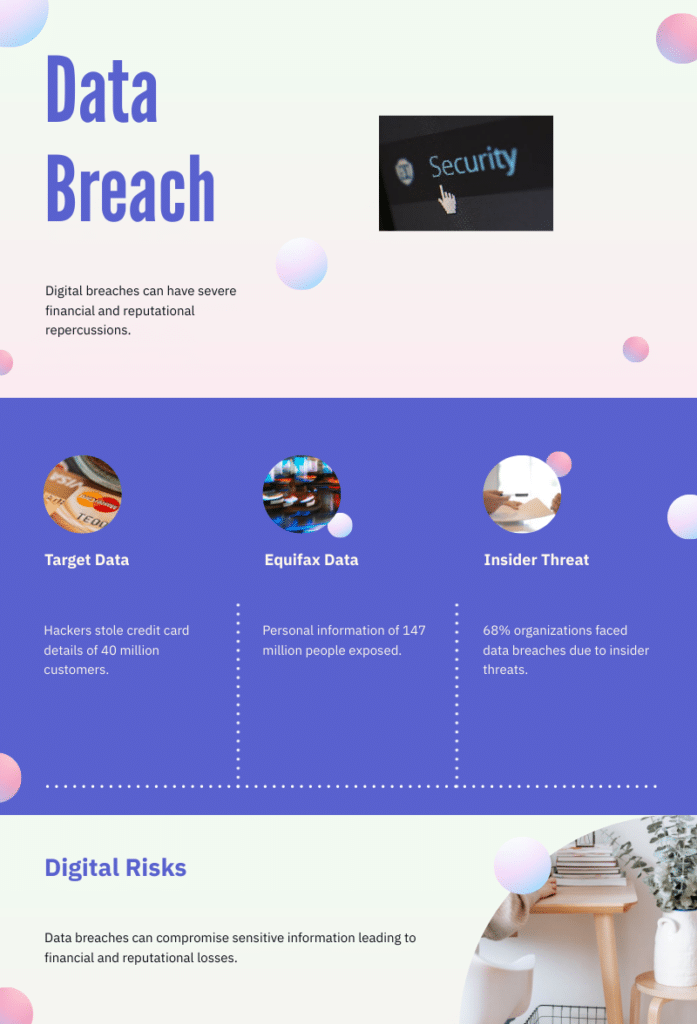

Data Breach Concerns

Traditional vs digital banking both invest heavily in cybersecurity and protecting their customers. However, digital banks are more vulnerable to cyberattacks because they operate entirely online. It’s worth noting though that traditional banks also face cyber threats but generally have a longer track record of dealing with them. Let’s quickly observe some data breaches between both types of banks:

Traditional Fraud Protection & Data Breaches:

- The Target Data Breach (2013) – In a high-profile incident, hackers implanted malware into Target’s security and payments system, aiming to steal credit card details from all transactions at its 1,797 US stores. Because of this, the details of 40 million credit and debit cards were stolen, negatively affecting Target’s reputation and bottom line. Source: Krebs, B. (2014). The Target Breach, By the Numbers. Krebs on Security. Retrieved from KrebsonSecurity

- Aberdeen Group Study on Financial Fraud – Aberdeen Group conducted a study revealing that traditional businesses often suffer reputational damage alongside financial loss after a security breach. 70% of the 6,000 companies surveyed reported that they had been victims of payment fraud. Source: Aberdeen Group. (2017). Detecting and Preventing Fraud with Data Analytics. Retrieved from Aberdeen Group

Digital Fraud Protection & Data Breaches:

- The Equifax Data Breach (2017) – One of the most significant data breaches in history occurred in 2017 when Equifax, one of the largest credit reporting agencies in the U.S, reported a breach. The breach led to exposure of sensitive personal information of around 147 million people. This incident painted a stark picture of the potential magnitude of cyber fraud in digital platforms. Source: Federal Trade Commission. (2019). Equifax Data Breach: What to Do. Retrieved from FTC

- Cybersecurity Insiders Threat Report (2020) – According to this report, 68% of organizations reported being victims of insider threats, proving that digital breaches can also come from within the organization. Source: Cybersecurity Insiders. (2020). 2020 Insider Threat Report. Retrieved from Cybersecurity Insiders

I believe these cases reveal clarity into the ongoing battle against fraud, both in traditional vs digital banking environments. They highlight the ever-present need for robust, multi-layered fraud protection measures to protect sensitive data and maintain trust with their consumers.

User Responsibility

Among these concerns, it is important to note with digital banking, much of the security responsibility falls on the user. You must ensure your devices are secure and that you follow best practices for online security. This includes setting up two-step verification and ensuring you are using a strong password amongst other things. Traditional banks take on more of this responsibility by managing security within their physical branches and ATMs.

Wrapping It Up

Both traditional vs digital banking types prioritize security, but the approaches differ. Traditional banks offer tried-and-true fraud protection and take on more security responsibility, while digital banks rely heavily on user vigilance and advanced cybersecurity measures. Whether you choose a traditional or digital bank may also depend on your comfort level with online security as both carry their own risks.

banking simplified: Convenience in the digital age

Service Speed

When it comes to traditional vs digital banking options, digital banks often provide faster service. The absence of physical branches means that digital banks can process transactions quickly and efficiently. Digital banks also tend to offer things such as the opportunity to receive your paycheck early. Traditional banks, with their bureaucratic processes, might take longer to complete this same task and others. Worth thinking about: how important is service speed to you?

Transaction Costs

Digital banks typically have lower operating costs and pass those savings on to customers through lower fees or higher interest rates on savings accounts. Traditional banks might have higher fees due to the cost of maintaining physical locations and having employees on-site to provide customer support. It is not unheard of with traditional vs digital banking to find no overdraft fees on digital banks, while traditional banks still tend to charge these pretty high fees.

Range of Services

While traditional banks offer a wide range of services from mortgages to investment products, digital banks tend to focus on core banking services like checking and savings accounts. However, many digital banks are beginning to expand their offerings as they grow.

Key Takeaways

In today’s financial world, both traditional vs digital banks offer unique advantages. Traditional banks win the race when it comes to providing in-person service and a comprehensive range of products, making them ideal for those who value personalized attention and all the works of financial offerings. Digital banks though, shine in offering convenience, speed, and lower costs, making them perfect for tech-savvy individuals who prefer managing their finances online and want to cut spending.

At the end of the day, the choice between traditional and digital banking boils down to personal preference and lifestyle. Evaluate your specific needs and choose the option that aligns best with your financial goals. Whichever you choose, both are capable and equipped to handle your banking needs.

Caught in a bind of choosing between traditional and digital? You could try enjoying the best of both worlds. Buckle up, enjoy the ride and head into the future of banking while keeping one foot firmly in the traditional. Wanna dive deeper into the world of finance and stay in the know with me? Okay cool! Join my mailing list to be the first to know when new blog posts drop.

Remember, financial literacy is the key to unlocking a world of opportunities, and with a touch of humor, it’s even more enjoyable. Let’s make money matters a tad less serious and a little more fun.